Safeguard Your Home and Loved Ones With Affordable Home Insurance Policy Plans

Significance of Affordable Home Insurance

Securing inexpensive home insurance coverage is vital for securing one's residential property and financial wellness. Home insurance policy supplies security versus numerous dangers such as fire, theft, all-natural disasters, and individual liability. By having a comprehensive insurance policy plan in place, property owners can relax ensured that their most considerable financial investment is secured in the event of unexpected circumstances.

Affordable home insurance not only provides economic safety but additionally offers tranquility of mind (San Diego Home Insurance). In the face of increasing residential property values and building prices, having a cost-effective insurance plan makes certain that house owners can quickly restore or fix their homes without encountering substantial financial problems

Additionally, inexpensive home insurance can likewise cover individual valuables within the home, offering repayment for products harmed or stolen. This coverage prolongs beyond the physical structure of the house, protecting the components that make a residence a home.

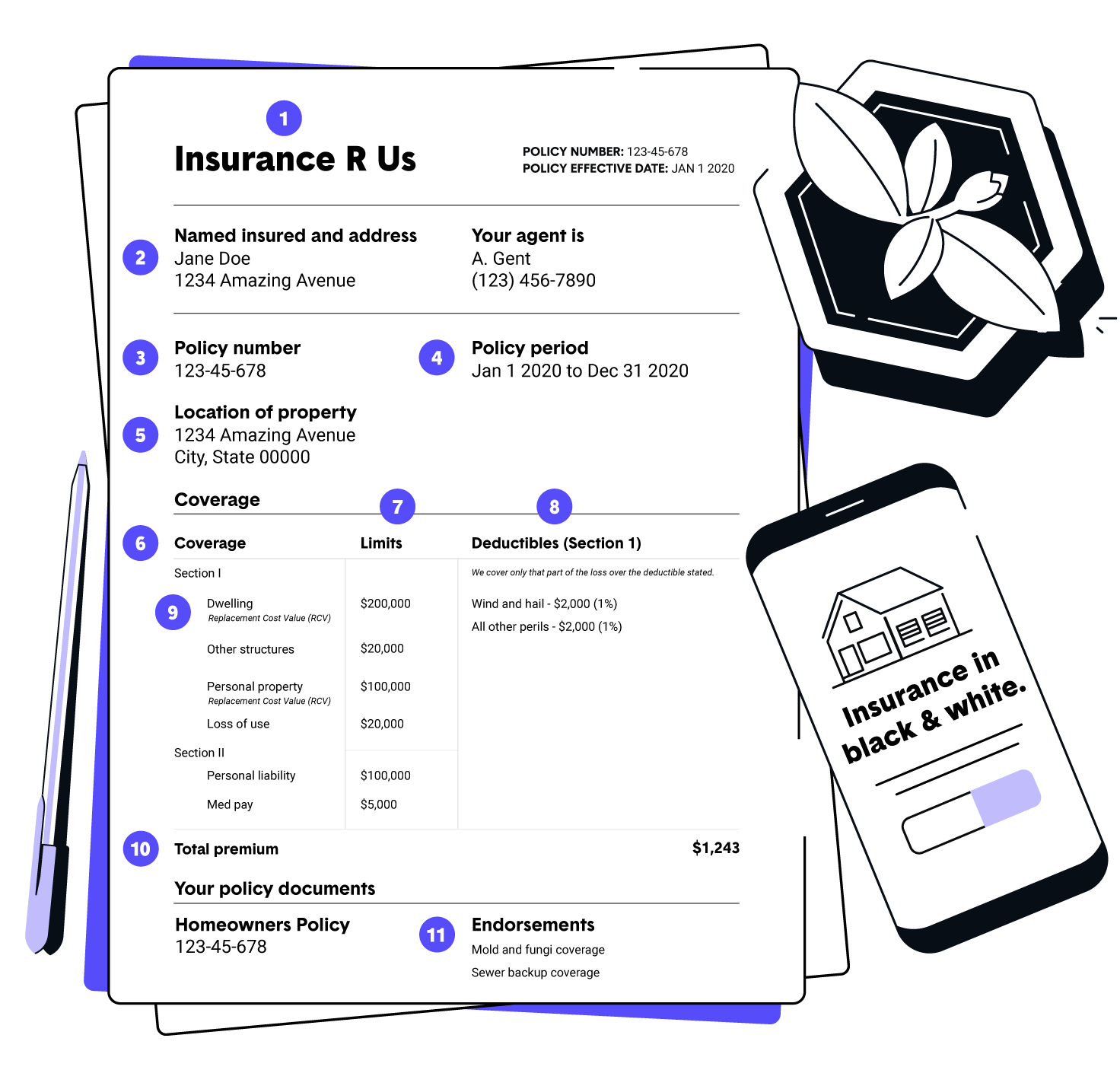

Insurance Coverage Options and Purviews

When it comes to insurance coverage restrictions, it's crucial to recognize the maximum amount your policy will certainly pay for each kind of coverage. These limits can vary depending on the policy and insurer, so it's vital to review them carefully to guarantee you have appropriate security for your home and properties. By recognizing the insurance coverage options and limitations of your home insurance coverage plan, you can make educated decisions to guard your home and enjoyed ones successfully.

Factors Impacting Insurance Coverage Expenses

A number of variables significantly influence the costs of home insurance policies. The location of your home plays a vital role in determining the insurance costs.

Furthermore, the sort of coverage you choose directly affects the expense of your insurance plan. Selecting added coverage options such as flood insurance or quake protection will increase your costs. Likewise, picking higher insurance coverage limits will lead to higher expenses. Your deductible amount can likewise influence your insurance costs. A higher insurance deductible normally suggests lower costs, but you will certainly have to pay more out of pocket in the occasion of a case.

Additionally, your credit report, declares history, and the insurer you pick can all influence the rate of your home insurance plan. By taking into consideration these factors, you can make informed decisions to aid manage your insurance costs efficiently.

Comparing Quotes and Suppliers

Along with contrasting quotes, it is vital to evaluate the online reputation and monetary stability of the insurance coverage providers. Look for consumer testimonials, rankings from read review independent agencies, and any kind of background of problems or regulatory actions. A dependable insurance coverage company ought to have an excellent record of quickly processing insurance claims and supplying excellent client service.

Additionally, take into consideration the specific insurance coverage attributes used by each carrier. Some insurers might use added benefits such as identity burglary defense, equipment malfunction insurance coverage, or protection for high-value items. By carefully contrasting providers and quotes, you can make an informed decision and pick the home insurance policy plan that best satisfies your needs.

Tips for Saving on Home Insurance Policy

After thoroughly contrasting companies and quotes to find the most suitable coverage for your requirements and budget plan, it is prudent to discover reliable strategies for saving on home insurance coverage. Numerous insurance policy firms use price cuts if you acquire several policies from them, such as combining your home and car insurance policy. Routinely examining and upgrading your policy to mirror any kind of adjustments in your home or circumstances can ensure you are not paying for coverage you no longer requirement, helping you conserve money on your home insurance coverage costs.

Final Thought

To conclude, protecting your home and loved ones with budget-friendly home insurance is crucial. Understanding coverage alternatives, restrictions, and elements affecting insurance prices can help you make notified Learn More choices. By comparing carriers and quotes, you can locate the most effective policy that fits your needs and budget plan. Implementing pointers for saving money on home insurance policy can also aid you secure the essential defense for your home without damaging the financial institution.

By deciphering the complexities of home insurance policy strategies and checking out practical approaches for securing economical coverage, you can make certain that your home and loved ones are well-protected.

Home insurance coverage plans usually provide several protection alternatives to secure your home and belongings - San Diego Home Insurance. By comprehending the insurance coverage alternatives and limitations webpage of your home insurance plan, you can make informed choices to guard your home and loved ones effectively

Frequently examining and upgrading your policy to reflect any changes in your home or circumstances can ensure you are not paying for coverage you no longer need, assisting you save cash on your home insurance costs.

In conclusion, securing your home and enjoyed ones with budget-friendly home insurance coverage is vital.